Top 5 Crypto Scams Beginners Must Avoid

Phishing, fake airdrops, impersonation, pump‑and‑dump groups, and Ponzi lending — here’s how to spot them and stay safe.

TrendReward is an independent marketing affiliate. This is not Bybit’s official website.

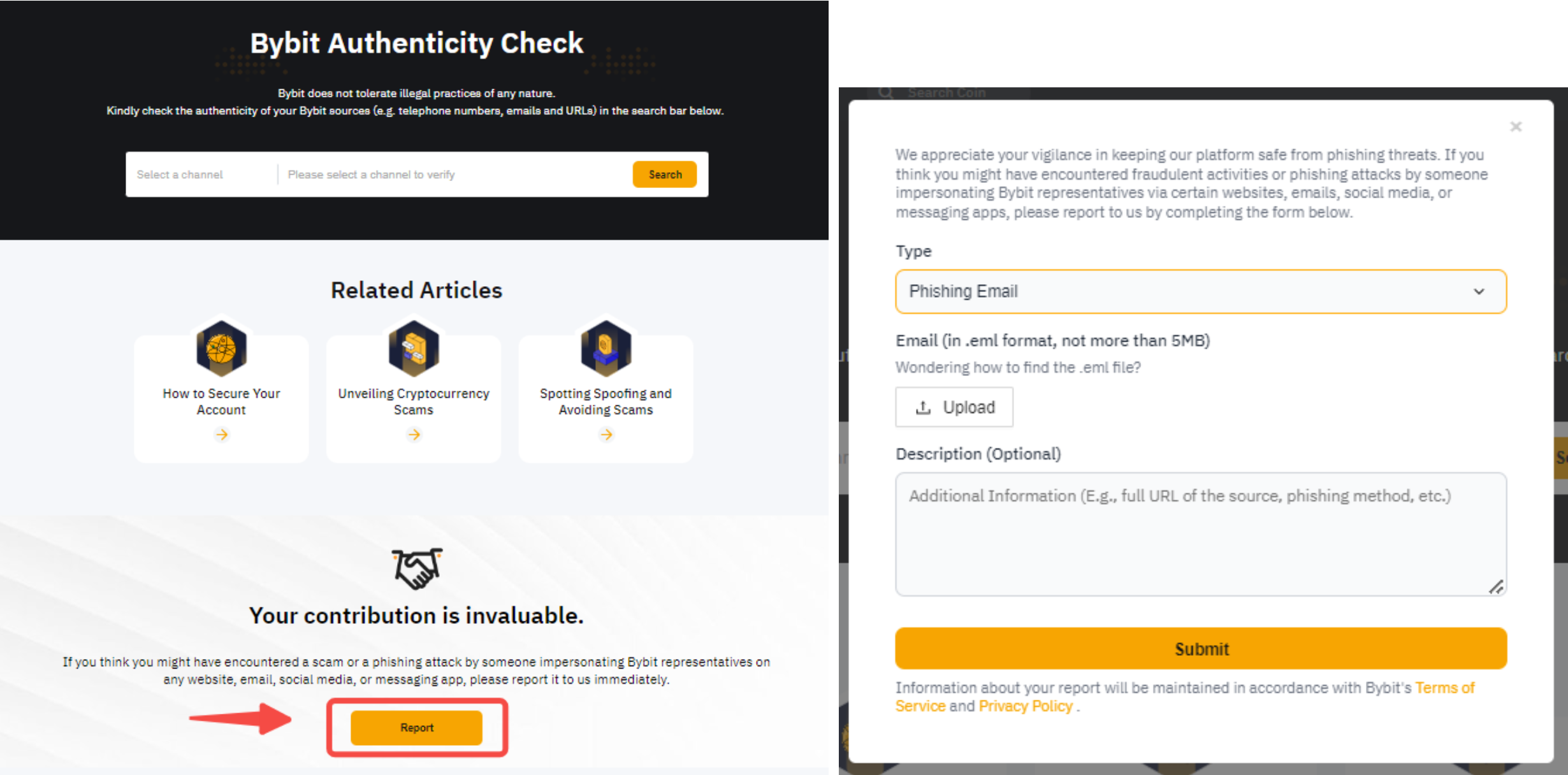

1) Phishing (Emails, DMs, Fake Sites)

Scammers mimic trusted brands or support agents to make you click a malicious link and enter your credentials/2FA on a fake page. Phishing is among the most common tactics flagged by regulators and exchanges.

- Red flags: urgent tone, requests for seed phrase/private keys, login links from unsolicited messages.

- How to avoid: check sender domain, compare the URL carefully, enable Anti‑Phishing Code so official emails include your code, and never share recovery phrases.

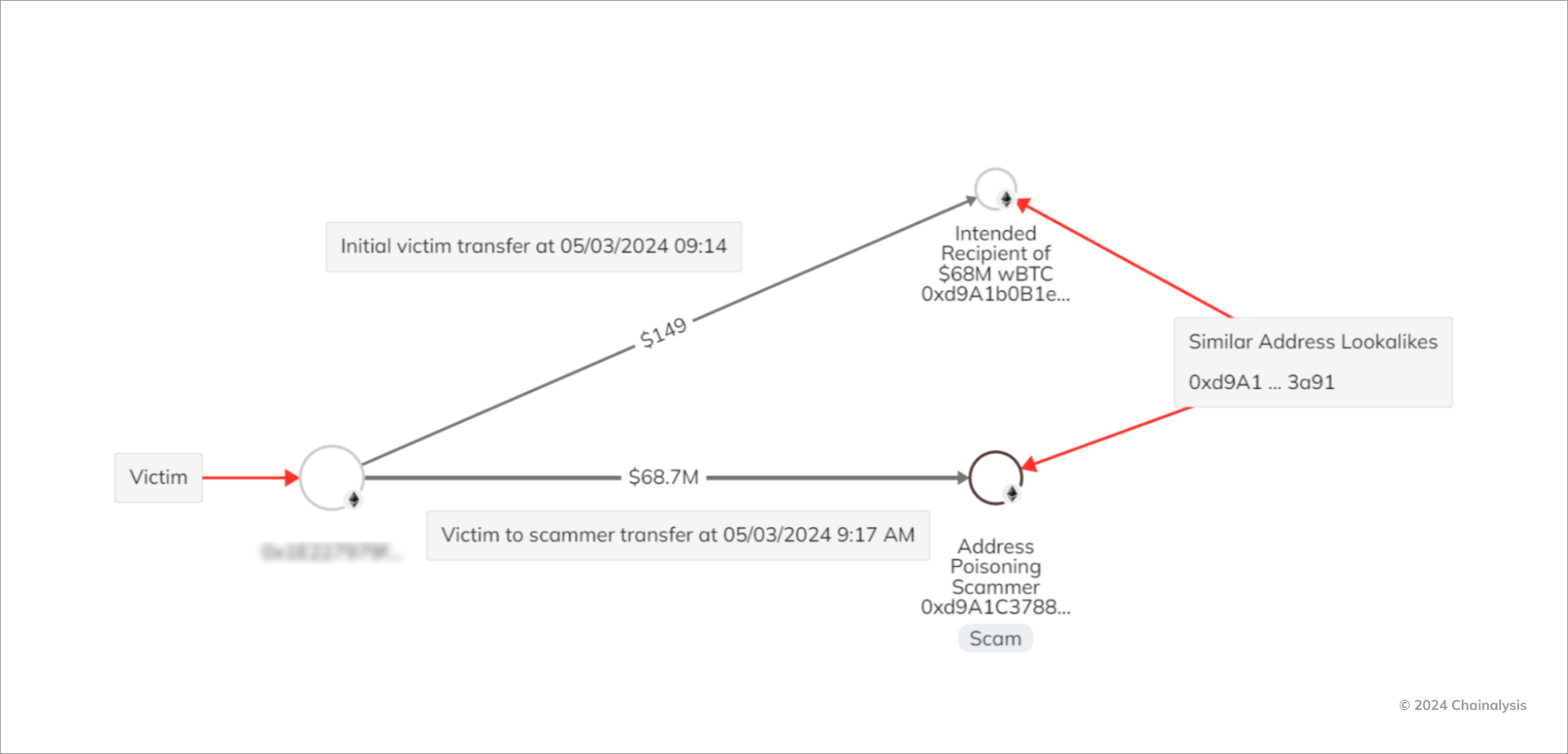

2) Fake Airdrops & Address‑Poisoning

Fake airdrops lure users to connect wallets or sign malicious approvals. Another rising variant is address poisoning: scammers seed look‑alike addresses so victims copy the wrong one when sending funds — linked to tens of thousands of spoofed addresses and high‑profile near‑misses.

- Red flags: “free tokens” requiring wallet approvals; zero‑value tokens in your wallet; look‑alike addresses (same first/last characters).

- How to avoid: verify contract sources, revoke suspicious approvals, paste addresses from your own verified address book, and compare full checksums — not just a few characters.

3) Impersonation (Celebrities, “Admins”, Support)

Fraudsters clone public figures or platform staff to gain trust and push “exclusive” investments or “support” actions. Watchdogs report heavy use of celebrity images and fake endorsements on social media; report channels include IC3/FCA.

- Red flags: unsolicited messages from “admin”, guaranteed returns, pressure to act fast, WhatsApp/Telegram group funnels.

- How to avoid: verify official handles, never pay “support fees”, and report imposters to IC3 or local authorities/FCA.

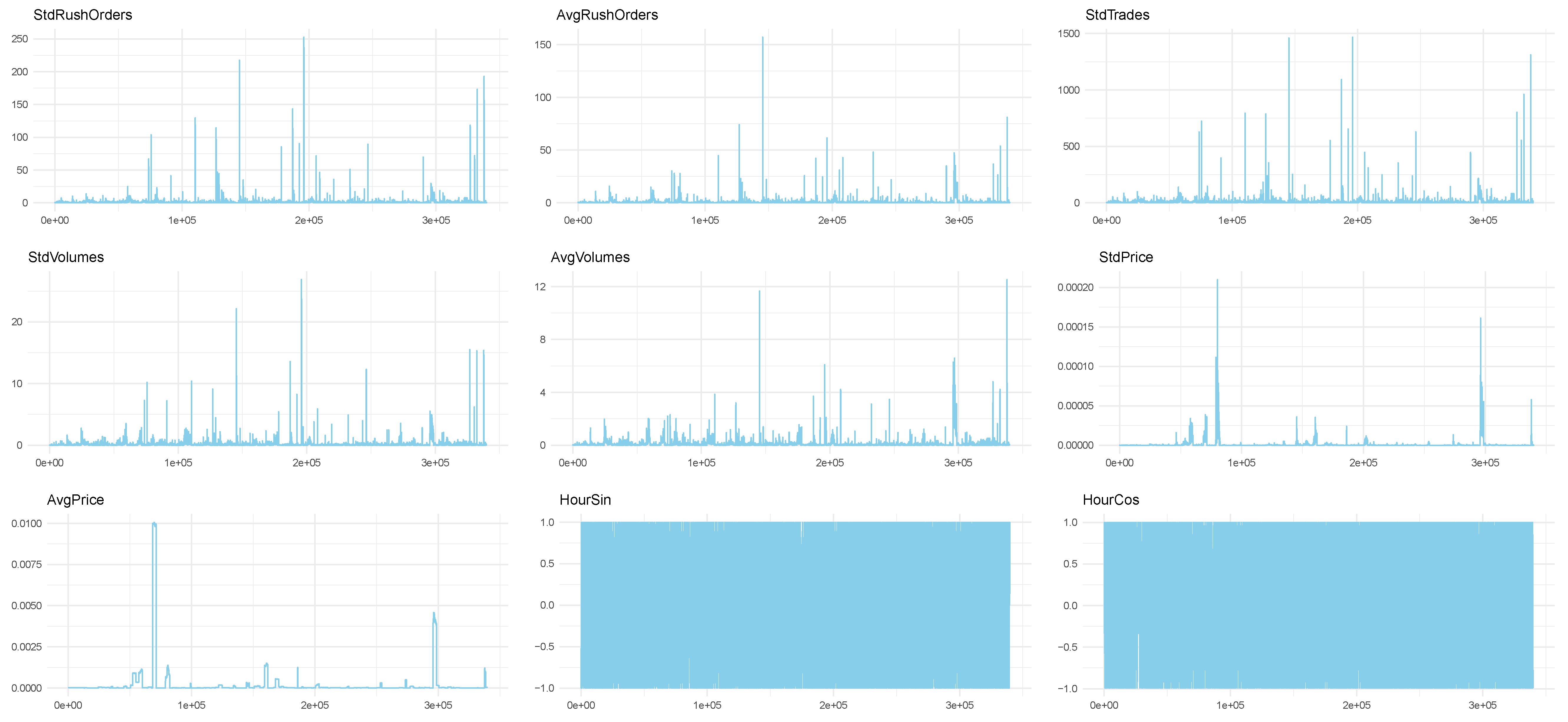

4) Pump‑and‑Dump Groups

Closed groups coordinate to inflate a token’s price, then insiders dump, leaving newcomers with losses. Regulators warn about social‑media‑driven promotion and clone platforms that simulate fake profits before blocking withdrawals.

- Red flags: “insider signals”, promises of quick multiples, screenshots of outsized gains, withdrawal issues after “profits”.

- How to avoid: stick to reputable venues, check liquidity, avoid illiquid micro‑caps, and ignore hype‑based calls.

5) Ponzi & High‑Yield “Lending”

Classic Ponzi promises steady, outsized returns and usually pays early “profits” from new deposits. Losses in scam categories remain large; law‑enforcement urges skepticism of unsolicited investment pitches and to report incidents.

- Red flags: guaranteed/APR claims, opaque strategies, pressure to reinvest, “VIP” tiers for bigger deposits.

- How to avoid: verify licensing/registration, start small, and walk away from “risk‑free” offers; report to IC3/FCA/your local authority.

Quick Safety Checklist

- Enable 2FA and set an Anti‑Phishing Code on your account.

- Verify domains, never share seed phrases, and double‑check wallet addresses.

- Be skeptical of unsolicited offers and celebrity endorsements online.

- If targeted, collect evidence and report via the FBI IC3 or your local regulator.

References (sources used to prepare this guide)

Phishing

Fake Airdrops / Address‑Poisoning

Impersonation

Pump‑and‑Dump / Ponzi

Haven’t set up your account yet? Safe Account Setup & Quick Verification →

Join When You’re Ready

Read at least one beginner & one safety guide before funding your account.

Go to Bybit (Official Site)*Opens a new tab; always review Bybit’s latest terms and policies.